February Update

Hey Vic...where's the video?! My apologies...I recorded the video and forgot to plug in the microphone! As a result, this month there's no video, and you'll have to settle for the written version. I'll do better in March! VL

Before we get into the markets and a normal update, there are a couple of housekeeping points that I have to make sure to address:

- I want to make everyone aware that I will be away and entirely unreachable from February 14 to March 1st. During that time, if you have any questions or need assistance, Joan will be your first point of contact. She can help you directly or coordinate things as needed. For any trading or securities-related matters, Meagan will handle them while I’m away.

- I want to mention that our phone system has changed, and you should find it much easier to reach the right person when you call our office!

- Finally, a quick reminder that March 2nd is the RRSP deadline. If you’re planning to contribute to your 2025 income, there is still time, but it’s something you’ll want to take care of sooner rather than later.

How much does the media influence your thoughts on the market?

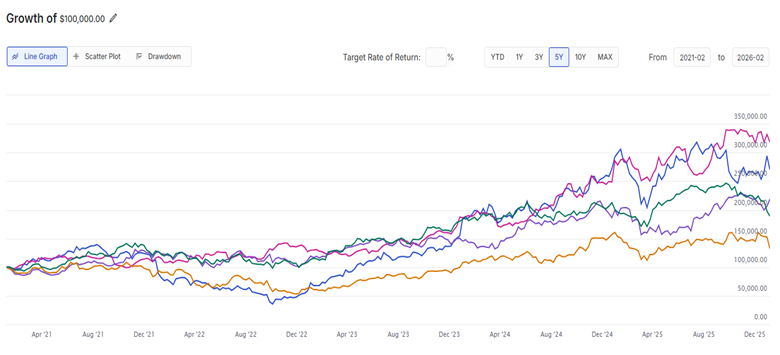

Here is a graph of five tech companies and their performance over the past five years. The question is which of these five has done the best over that period:

No cheating, but which company is which? I’ll have the answer at the end of this update. Here are the choices in alphabetical order: Amazon, Apple, IBM, Meta, Microsoft.

This market feels uncomfortable…but we’re still confident!

If it’s felt like markets are pulling in different directions recently, you’re not imagining it. January itself was relatively smooth and stable, but that stability is what makes volatile periods feel more jarring. If we thought that 2025 was volatile and chaotic at times, we might want to steady ourselves for 2026. In these times, though, it’s important to distinguish what is “headline noise” from what is taking place in the markets.

From a performance perspective, January started the year on a positive note. The Orion Fund was positive in January, finishing with a 4.3% gain. The fund held up well through the volatility that we saw increase at the end of January. For a little bit broader context, the S&P 500 was up about 1.4% in January. I really only mention that because last month I mentioned the saying “as January goes, so goes the rest of the year”. While none of those adages are 100% accurate, this has proven accurate about 89% of the time historically, so we have another reason to have a little optimism!

Volatility is normal, even in positive years

It’s important to remember that market volatility doesn’t mean something is wrong. Markets don’t move in straight lines, even when things are going well. We see pullbacks, pauses, and periods of uncertainty. Those are a normal part of being invested in the markets over the long term.

What we’re seeing right now is markets processing a mix of economic signals and data. Some show signs of slowing, some show continued resilience, and then we have relatively normal conversations about interest rates, employment figures, and economic growth. Different sectors and asset classes can behave very differently, and there are many reasons we see this.

It can all feel very messy! It’s normal, and a healthier market environment than what we can see during times of extreme optimism.

How can we remain confident?

One of the key advantages of discretionary management is that you don’t have to react to every headline or market move. The portfolios are actively monitored and managed on an ongoing basis. This means that risk is being managed intentionally, diversification is helping us manage that risk, and portfolio adjustments are made thoughtfully, not rashly or based on emotion. While markets are moving day to day, we’re basing our decisions on structure, discipline, and long-term objectives.

Below the headlines, things are more constructive

Despite what can feel like a constant stream of concerning headlines, there are encouraging factors to consider. The markets have absorbed and processed a tremendous amount of uncertainty over the past few years. We’ve seen everything from inflation spiking to rate increases, geopolitical issues, and a changing global trade order.

Businesses and consumers have shown that they are adaptable, and earnings have been resilient, generally speaking. Valuations across many areas are reasonable, and it shows that markets don’t need perfect conditions to grow. They need conditions to become less uncertain over time.

While markets may remain uneven, there are good reasons to remain calm and confident. Our portfolios are actively managed, and we monitor risk on an ongoing basis. We make decisions with intention and base them on structure, not on emotion.

Now, to circle back to the impact of media on your market thoughts, here is the answer to the graph. From top to bottom, the highest return was IBM, followed by Meta, Apple, Microsoft, and Amazon. I was surprised to see IBM at the top of these five, although I’m not sure that I realised how far behind Amazon was over the last five years either. We seemingly never hear about IBM in the news, which illustrates how influenced we are by what is reported in the media. Suffice it to say, investing based on what you see on the news or read online isn't always going to get you the best outcomes.

Until next month!

Vic